Bond equivalent yield formula

Enter the scientific value in exponent format for example if you have value as 00000012 you can enter this as 12e-6. The bond equivalent yield formula is used to determine the annual yield on a discount or zero coupon bond.

Bond Yield Calculator Factory Sale 60 Off Www Ingeniovirtual Com

I The nominal interest rate on the bond n The number of coupon payments received in each year Practical Example Assume that you.

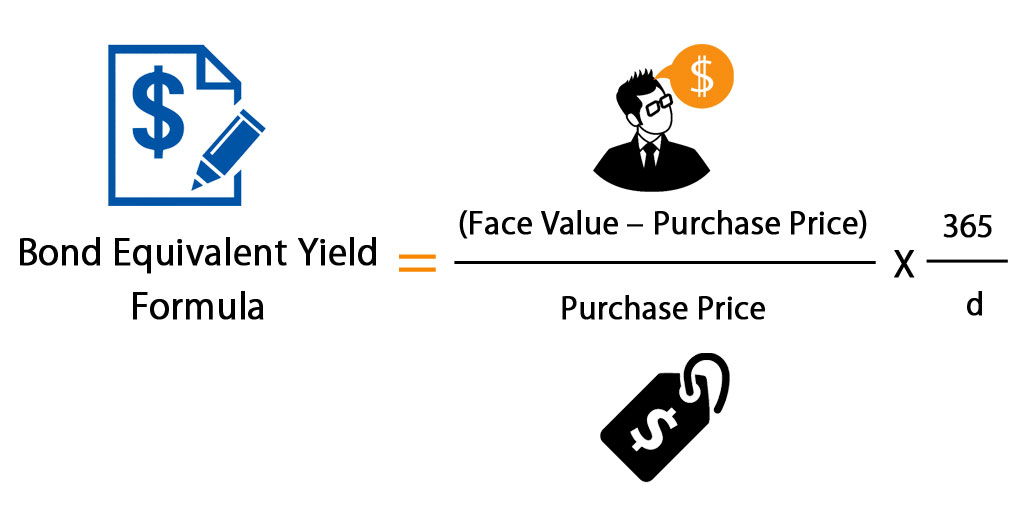

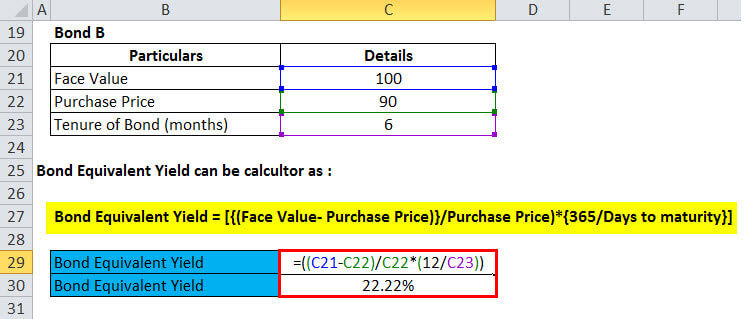

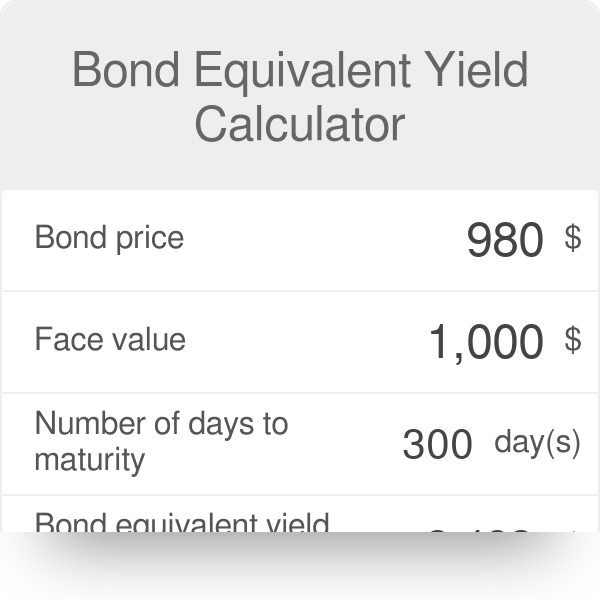

. For example if you want to convert a bond-equivalent yield of 6 percent into a monthly-equivalent yield substitute 006 into the formula to get 12 x 1 0062 16 - 1. Following is the bond equivalent yield formula on how to calculate bond equivalent yield. BEY face value - price price 365 days.

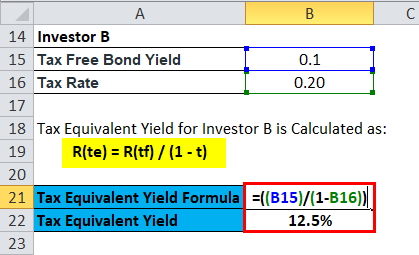

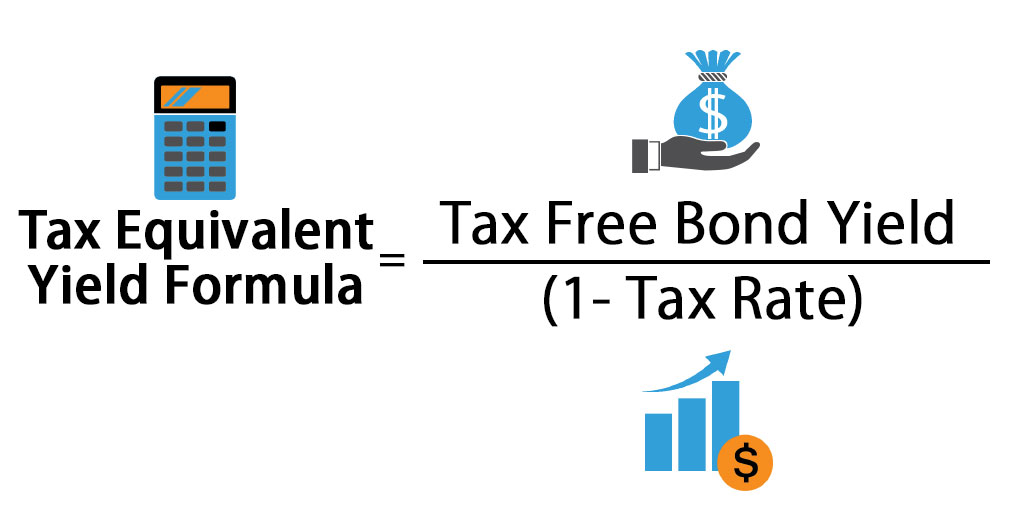

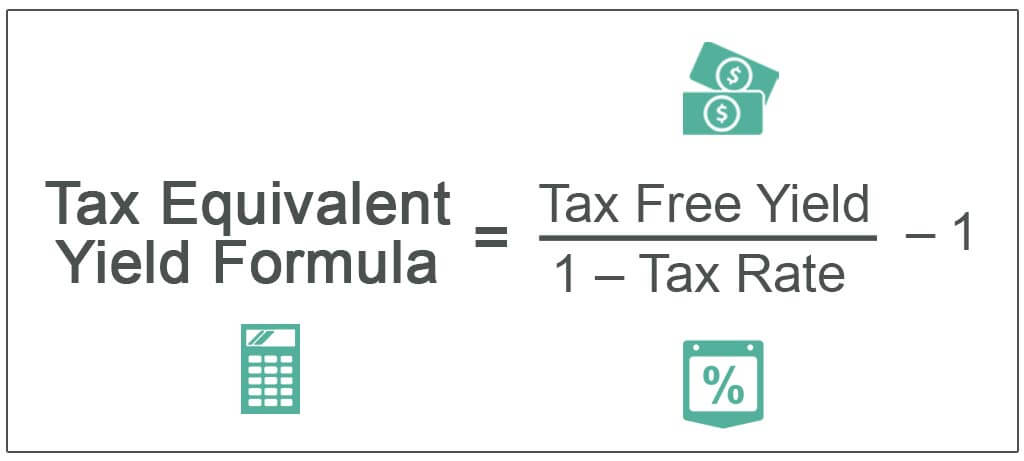

Return TEY 008 1 022. Find the reciprocal of your tax rate 1. Firstly determine the potential coupon payment to be.

Effective Yield 1 in n 1 Where. The BEY is calculated as follows. Bond equivalent yield face value price price x 365 d Let us solve the example.

Heres how you calculate the TEY in a few steps. BEY 1 EAY 12 1 x 2 Alternatively the semiannual YTM BEY can be converted to annual YTM EAY equivalent annual yield using the following formula. Bond equivalent yield 85 80 80 x 365 d The yield hence earned from the aforementioned bond.

The simplest way to calculate a bond yield is to divide its coupon payment by the face value of the bond. The bond equivalent yield formula is calculated by dividing the difference between the face value of the bond and the purchase price of the bond by the price of the bond. To calculate the fully taxable equivalent yield that a taxable bond would have to earn to match the municipal bonds yield use the above formula.

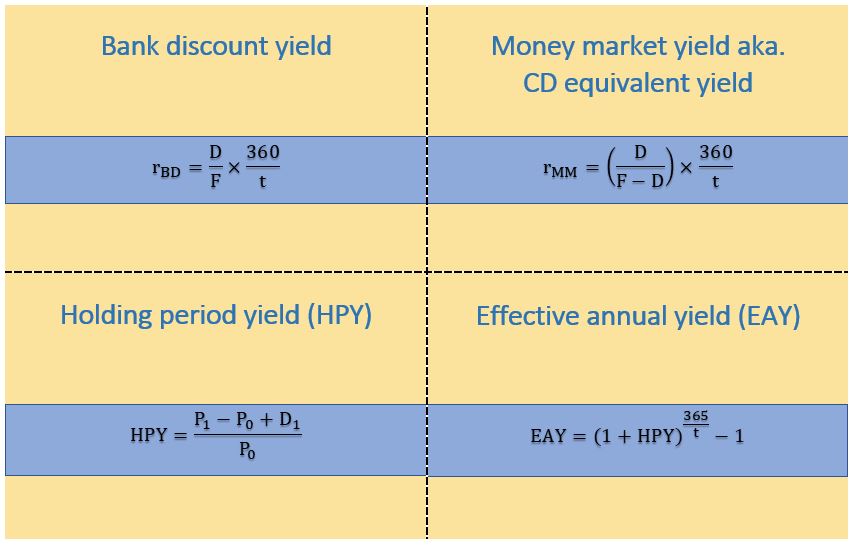

EAY 1 BEY 2 2 1. Calculating Tax Equivalent Yield The good news is that the calculation is not too hard. When making investment decisions comparing the yield or returns on the.

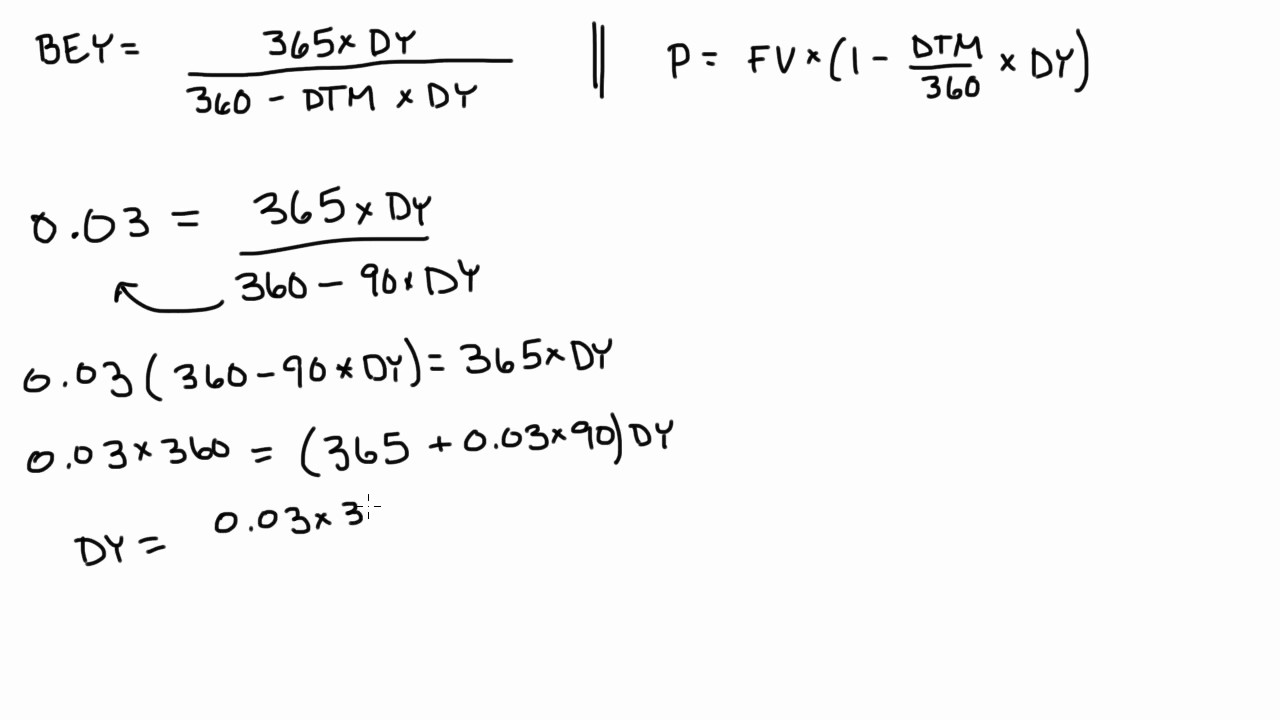

Calculate the bond equivalent yield BEY The last step is to calculate the BEY using the bond equivalent yield formula shown below. Bond Price Cash flowt 1YTMt The formula for a bonds current yield can be derived by using the following steps. This is called the coupon rate.

Please use the mathematical deterministic number in field to perform the. Bond Equivalent Yield Formula. 2 text Coupon Ratefrac text.

The bond equivalent yield is calculated by first taking the face value or par value the amount paid at maturity subtracting the price the amount originally paid and then. Bond Equivalent Yield Face Value - Purchase Price 365. The calculation of the bond equivalent yield involves three factors the face value the purchase price of the bond and the time to maturity.

Tax Equivalent Yield Formula Calculator Excel Template

Bond Equivalent Yield Formula With Calculator

Tax Equivalent Yield Formula Calculator Excel Template

Bond Equivalent Yield Bey Definition

Bond Equivalent Yield Formula Calculator Excel Template

Bond Equivalent Yield Prepnuggets

Money Market Yields For Level 1 Cfa Candidates Soleadea

Bond Equivalent Yield Formula Calculator Excel Template

Tax Equivalent Yield Meaning Formula How To Calculate

Bond Equivalent Yield Prepnuggets

:max_bytes(150000):strip_icc()/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Bond Yield Formula Calculator Example With Excel Template

Bond Equivalent Yield Calculator Bey

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Fixedincome Securities Chapter 2 Bond Prices And Yields

Free Equivalent Hotsell 60 Off Www Quadrantkindercentra Nl

Bond Equivalent Yield Example 2 Youtube